Latinclear

History

1989

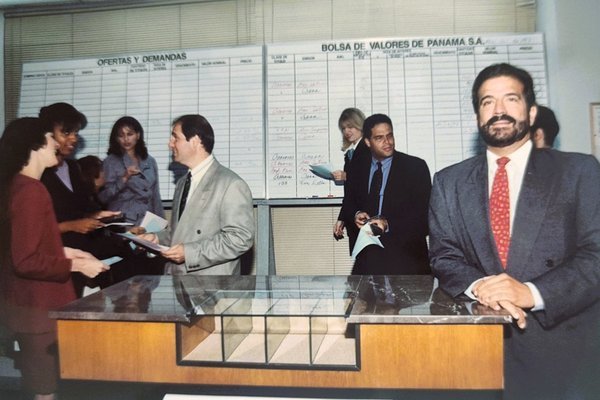

Foundation of the Panama Stock Exchange

When Panama was going through the worst political and economic crisis in its republican history, a group of businessmen tried to crystallize one of the projects most desired by the local financial community, the founding of a stock exchange. This private sector initiative had the objective of operating a centralized negotiation mechanism where the forces of supply and demand for securities freely converge, under the precepts of transparency and equity. For this purpose, the Panama Stock Exchange is created.

1990

Start of operations of the Panama Stock Exchange

On June 26, 1990, the Panama Stock Exchange began operations by carrying out its first trading session, thus beginning a new stage in the development of the securities market in Panama.

1997

Start of operations of the Latin American Securities Central

In parallel with the quantitative evolution, the Panama Stock Exchange promoted measures aimed at modernizing the local securities market, which highlights the creation of a securities custody and settlement center, which resulted in the start of operations in 1997 of the Central Latinoamericana de Valores, whose operational service provided efficiency in the settlement and clearing of transactions that were previously done manually.

2010

Creation of Latinex Holdings

On October 22, 2009, the shareholders of the Panama Stock Exchange approved in an Extraordinary Assembly a corporate reorganization of this company, as did the shareholders of Central Latinoamericana de Valores, to establish a holding company for both shares, called Latinex Holdings. Inc., commencing trading of the new common shares in 2011.

2014

iLink

With the objective of internationalizing the Panamanian securities market, in August 2014 the Latin American Securities Central established a link with Euroclear Bank, allowing international investors access to instruments of the Republic of Panama and Quasi-governmental instruments.

2015

Market integration

On September 22, 2015, the agreements that would allow the integration of the securities markets of El Salvador and Panama were signed, opening the way to the concept of unifying the member countries of the Association of Markets of the Americas (AMERCA).

2019

Nasdaq ME

With the focus of being an International Hub of the capital market, the Panama Stock Exchange acquires the Nasdaq ME trading system, providing greater technological support in terms of connectivity and robustness to negotiations, expanding the horizon towards a market with standards international.

2021

Makeover

On June 30, 2021, after 31 years, the Panama Stock Exchange has presented its new corporate image to the national and international market, now becoming the Latin American Stock Exchange, also known as Latinex. This change of corporate image responds to the strategy of expanding horizons and becoming an International Hub of the stock market, but with the same commitment to be your investment ally, now in Latin America and the world, maintaining characteristics such as: agility, solutions profitable, clear, accurate, timely information and friendly treatment, supported by world-class technology and with a high commitment to sustainable finances.

2024

iLink - Fase 2

Latinclear concreta la internacionalización del mercado de capitales de Panamá con el enlace iLink con Euroclear Bank. Este acuerdo, vigente desde 2014, permite que las emisiones de deuda corporativa y multilaterales sean euroclearables y accesibles a inversionistas internacionales. Los beneficios incluyen mayor liquidez, diversificación de inversionistas y convertibilidad de valores.